Summary

- This dataset aggregates daily data on European natural gas import flows and storage levels.

- Acute interest has developed in these indicators in response to soaring energy prices which are largely due to a tight natural gas market.

- The behaviour of Gazprom in using (or not using) specific supply routes and storage facilities has been the focus of public attention.

- We hope this dataset – which we will regularly update – provides some easily usable insight into the current status of European natural gas supply situation.

First published: 16 June 2022

Latest update: 12 December 2024

On 22 August 2024, we updated the LNG terminals list with new facilities, revising LNG data upwards.

To download the data of the figures please use the download button in the top-left of the page. For any questions or comments, please get in contact with greeneconomy@bruegel.org.

Figure 1 shows weekly extra-EU27 imports of natural gas for 2021 and 2022, compared with weekly minimum and maximum import values for the period 2015-2020. By selecting from the dropdown, the figure shows total imports but also imports exclusively from Russia, Norway, Algeria, Azerbaijan pipelines, liquefied natural gas (LNG, gas transported by ship from around the world), and the net imports from the UK.

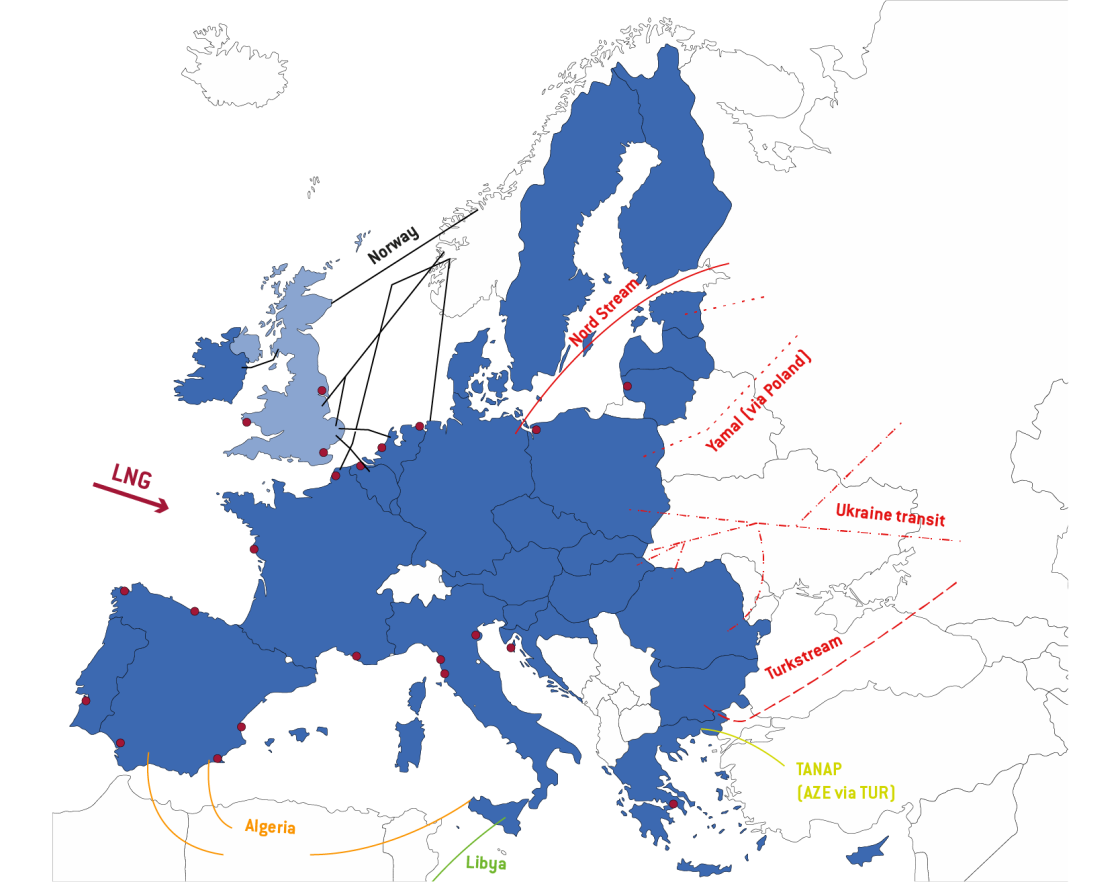

The map (Figure 2) displays the most relevant pipeline import routes into the EU and the location of LNG terminals. The largest share of gas used to be delivered from Russia via four distinct corridors Nord Stream, Yamal (via Poland), Ukraine, and Turkstream (via Turkey). These different Russian gas routes are at the heart of current geopolitical tensions.

Figure 2: Main EU Natural Gas Imports routes covered in our analysis

Source: Bruegel

Figure 3 shows weekly import data via each of these routes, again comparing to the minimum and maximum values from the period 2015-2020.

Figure 4 displays EU27 LNG monthly imports by region of origin since January 2020. While in summer 2021 natural gas imported from Russia via pipeline started to diminish, Russian LNG volumed reaching European LNG terminals have, to date, remained unaffected.

Figure 5 depicts quarterly EU imports of natural gas since Q1 2021, providing an overview of the evolution in volumes from different suppliers over time.

Figure 6 shows the weekly rate of regassification usage in 2022 versus the 2019-2021 average for those EU countries having operative LNG terminals. The rate of regassification capacity use may signal where supply bottlenecks are located.

Figure 7 shows actual daily imports for the last 30 days. Imports are split by Russian routes, as well as shown for Norway, Algeria, Azerbaijan, LNG and the net imports from the UK.

Alongside import volumes, the levels of storage within the EU’s borders are key for providing (or not) reassurance to markets.

In Figure 8, we provide data on current weekly levels of storage in the EU and in Ukraine.

Figure 9 shows the natural gas gross-exports from EU countries to Ukraine. Flows might increase if the EU traders use more of the Ukrainian gas storage potential.

In the first tab of Figure 10, we show the current storage level and the relative maximum storage capacity by country. In the second and third tabs it is displayed the change in storage level occurred in the last 30 days.